On January 4, 2023, the Centers for Medicare & Medicaid Services (CMS) released an updated Physician Fee Schedule (PFS) Relative Value File for 2023. Previously, as of November 1, 2022, CMS had released its Final Rule and the Relative Value File (mentioned above), which included their annual updates and policy changes for Medicare Part B payments under the Physician Fee Schedule. This file incorporated a new conversion factor for 2023 of $33.06, which resulted in a 4.5% decrease from the 2022 conversion factor. Through much scrutiny and discussion from the healthcare industry, CMS republished a new file on January 4, incorporating an updated conversion factor for 2023 of $33.89, resulting in a 2.1% decrease from the 2022 conversion factor.

The yearly percentage change of the CMS PFS conversion factor can have significantly different impacts from one healthcare provider to another. The final 2.1% decrease for 2023 is the conversion factor across all allowable services from CMS, but the list of allowable services from CMS is reviewed annually for changes in the total relative value unit (RVU). Depending on a change in the RVU value of a specific service, this conversion factor decrease can potentially impact reimbursement materially. So, although the conversion factor may decrease by 2.1%, if the RVU value also decreases, this would result in a higher decrease in the final reimbursement rate for 2023. Similarly, if the RVU figure for a certain service increases in 2023, then the ultimate effect on reimbursement would not be as drastic and, in certain cases, could cover the conversion factor decrease completely, resulting in a higher reimbursement in 2023 versus 2022.

This article highlights the variation from one provider (or practice) or specialty to another and, depending on which services a given provider delivers, the impact of the 2023 CMS PFS. The majority of contracts with commercial payors are based off the annual CMS PFS, and the annual effects on these CMS changes will directly affect commercial contracted reimbursement rates as well.

Below, we present two different multispecialty groups, highlighting the wide variation from one group to another, as well as the overall impact of the 2023 CMS PFS within each group based on their primary care and specialty care services provided.

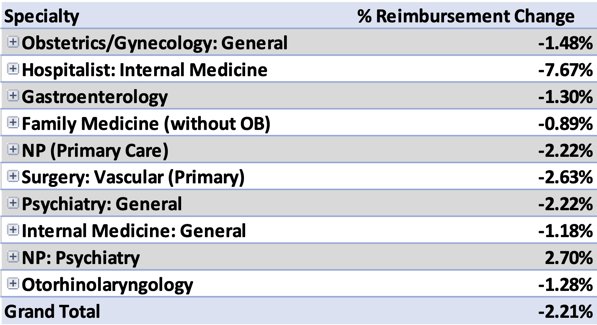

TABLE A: GROUP 1

As you can see in Table A above, the overall Group 1 decrease is approximately 2.2% from 2022 to 2023. The Hospitalists providers could potentially see as high as a 7.7% decrease year-over-year, while the Family Medicine physicians may see as small as a 0.9% decrease. Notice, although the CMS conversion factor is decreasing by 2.1%, Group A decreases year-over-year by a slightly higher rate of 2.21% because of the overall service mix.

If CMS had not revised the original final rule and conversion factor from $33.06 to $33.89, the effect on this group would have more than doubled overall, with a total 4.61% decrease from 2022 to 2023.

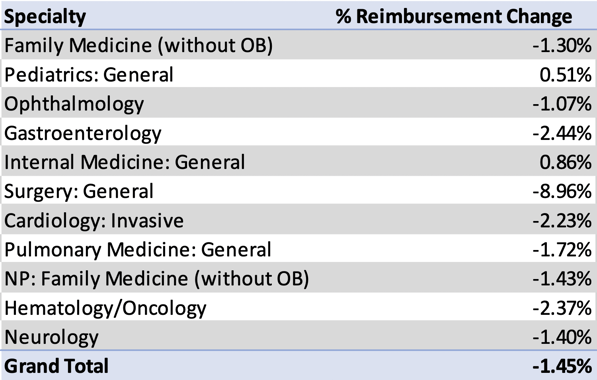

TABLE B: GROUP 2

Group 2 shows a slightly lower negative impact than Group 1. For Group 2, the biggest change will be seen in General Surgery, with a nearly 9% decrease year-over-year. Important to note, the specific services one group offers within a specialty could be different than another. For example, Group 1’s Gastroenterology services will see an approximate 1.3% decrease, while Group 2’s Gastroenterology group will see nearly a 2.5% decrease. The specific services and CPT codes provided by those Gastroenterology practice providers are different and therefore result in significantly different projections for 2023.

If CMS had not revised the original 2023 conversion factor in this case, Group 2 could have seen nearly 4% cuts in overall reimbursement for their service offerings.

Summary

Although the CMS PFS Conversion Factor continues to decrease each year with no sign of stopping, it is crucial that healthcare groups and professional organizations like MGMA and HFMA continue to lobby on behalf of their members. In the meantime, healthcare groups and physician practices should strive to improve operations, find new ways to cut costs, and become increasingly efficient to help remedy the annual decreases in reimbursement.

Anthony Morino is a Senior Consultant - Analytics with Medic Management Group, LLC. In that capacity, he supports both health system and independent practice clients in the generation of actionable data, execution of initiatives based on business analysis, compliance, and reporting.