On November 1, 2022, the Centers for Medicare & Medicaid Services released the 2023 Final Rule that included updates and policy changes for Medicare Part B payments under the physician fee schedule. The main takeaway from this announcement is that the conversion factor will dip from $34.61 in CY 2022 to $33.06 in CY 2023. This 4.48% decrease is due to the expiration of the temporary 3% payment increase provided by Congress for CY 2022. The additional cuts are the result of budget neutrality requirements that stem from revised Evaluation and Management (E&M) Changes to the current procedural terminology (CPT) codes.

The purpose of this article is to identify heavily utilized CPT codes across specialties and highlight the services that will experience the most significant financial effects in their reimbursement. CMS is the most impactful payor for providers, as most payors (both other governmental and commercial) base their own reimbursement schedules off the CMS Physician Fee Schedule in some manner (normally seen as a percentage of the CMS fee schedule), each year. In summary, a change to the CMS rates equates to a similar change in almost all other payor reimbursement rates.

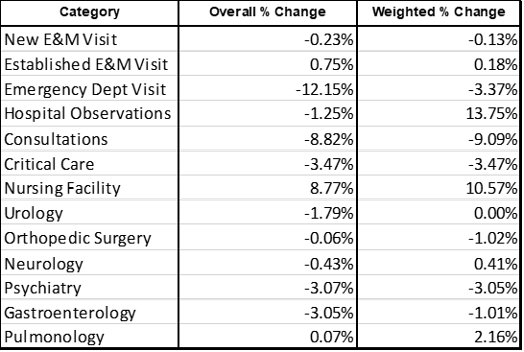

Table A shows the overall and weighted percentage reimbursement change by CPT category between the current 2022 and expected 2023 Medicare physician fee schedule. This is based on the CPT codes and utilization that the Medical Group Management Association (MGMA) uses to group each of these categories and specialties. We further examine each of these categories below.

Table A

As an additional note, in 2021 CMS had significant revisions to office and outpatient E&M visits that allowed physicians to select the E&M visit level they billed based on either total time spent on the date of the patient encounter or the medical decision making utilized in the provision of the visit. For 2023, CMS will implement similar revisions for other E&M visit codes, including inpatient and outpatient observations, Emergency Department (ED) visits, nursing facility visits, domiciliary visits, and home visits. The revisions will allow for time or medical decision making to be used when selecting the appropriate code for the E&M visit.

Split (or Shared) Visits

CMS has delayed the implementation of its policy that defines the substantive portion of a split or shared visit based on the amount of time spent by the billing practitioner to January 1, 2024. Under this policy, if a non-physician practitioner performed 50% or greater of an E&M visit and billed for it, Medicare will only pay 85% of the physician fee schedule rate.

Evaluation & Management Codes

New Office Visits

Overall, there is hardly any change on the New Outpatient Office Visit E&M codes for 2023. The overall weighted average across codes 99202-99205 is decreasing by 0.13%. The largest change this year was the 0.8% decrease to 99205. While providers will be paid $1.73 less per unit (from $217.28 in 2022 to $215.55 in 2023), it is important to understand that this code is only utilized in 5% of all new E&M outpatient visits. 99203 is the most common code in the group and has increased 0.24 %, while the second most common code, 99204, will be decreasing 0.51%. While some of these numbers are decreasing, their overall impact on most practices should be negligible. That said, it is advisable that each practice review the details to determine their direct impact.

Established Office Visits

Similar to the New Office Visit codes, the Established Outpatient Office Visits also have very marginal changes in 2023. The weighted average change is only a 0.18% increase. The most significant change is the 3.27% increase to the seldomly used 99211 level 1 established code. Overall, providers who bill a lot of established outpatient visits should not expect major financial implications due to the change to the 2023 fee schedule.

Emergency Department Visits

While the first thing that jumps out is the 47.36% decrease in CPT code 99281 (ED visit level 1), MGMA data shows that this code is billed less than 1% of all ED visits. The more important numbers are the commonly billed 99283-99285 that are all decreasing by around 3%. This deduction in the rate should be noted and budgets should be adjusted accordingly with these changes in mind. The overall weighted decrease for codes 99281-99285 is 3.37%. Starting in 2023, ED code levels will be determined by medical decision making only. Medical history and physical exams should be documented but will no longer be considered when determining which level ED code to bill.

Hospital Observations

The main takeaway from the Hospital Observations category is that, while the initial and same day care/observations are decreasing across the board, the most frequently utilized subsequent care codes (99231-99233) are all increasing by more than 10%. It will be very important for health systems and hospitalists groups to know that – based on historical trends of MGMA-surveyed groups – the 2023 fee schedule may actually benefit them despite the large decreases in overall CPT rates, and bill the subsequent hospital care codes. Overall, the weighted average in payment will be increasing 13.75%, while the overall average percent change is decreasing 1.25%. Once again, this is due to large decreases in codes 99221-99223 and codes 99234-99236. Also note that CPT codes 99224-99226 (Subsequent Hospital Observation Care Services) will be deleted from the CMS fee schedule starting in 2023 and will be non-reimbursable codes.

Consultations

Both Office and Inpatient Consultations CPT codes (99241-99245 & 99251-99255) are among the E&M categories that will be most negatively impacted by the 2023 CMS fee schedule. The overall average decrease will be 8.82%, while the weighted decrease will be 9.09%. Also, specific CPT codes 99241 and 99251 have been deleted from the CMS fee schedule starting in 2023 and will be non-reimbursable codes.

Critical Care

Critical Care codes will have a flat 3.47% decrease for both 99291 and 99292 in 2023. These codes will not be impacted by the changes that ED billing is undergoing because they are time-based codes and have no MDM component in their description.

Nursing Facility

Nursing facilities are one of the categories seeing the largest increase in 2023. Around 90% of the nursing home codes billed (99304-99310) will see an increase in 2023. The most notable increases are 8.67% and 18.24% increases to 99308 and 99309 (subsequent nursing facility care) respectively. Code 99318 has been deleted from the CMS fee schedule starting in 2023 and will be a non-reimbursable code.

Specialists

Urology-Specific CPT Codes

Urology is one of the specialties seeing the least amount of change in 2023. The weighted percent change is only a .003% decrease overall. While the overall change will be minuscule, it is important to note a few updates to commonly billed codes. The reimbursement for code 51798 (measurement of post-voiding residual urine and/or bladder capacity by ultrasound, non-imaging) will be increasing 7.32%, while CPT code 52000 (Endoscopy-Cystoscopy, Urethroscopy, Cystourethroscopy Procedures on the Bladder) will be decreasing 2.53%. These are by far the most billed urology codes according to MGMA, so it will be important to note how these changes will affect each urology group’s direct reimbursement.

Orthopedic Surgery-Specific CPT Codes

Orthopedic Surgery is another specialty that can expect marginal changes in the new year. The weighted average is expected to decrease 1.021%, while the overall average is only expected to decrease .06%. Some of the most notable changes are the 1.89% decrease to code 20610 (arthrocentesis major joint without ultrasound guidance) and the 1.26% decrease to both codes 27447 and 27130 (knee replacement and total hip arthroplasty, respectively).

Neurology-Specific CPT Codes

Neurology is one of the few specialties expected to see a small increase in reimbursement in 2023. Providers can expect to see a 0.40% increase to weighted average, while the overall average is down 0.43%. This is being driven by an increase across the board on all EEG codes (99812-99822), which will all be increasing between 3-5% for the new year. The commonly billed CPT 96886 will see a 0.81% decrease this year, which is one of the main factors in the difference between the weighted and overall percentage change.

Psychiatry-Specific CPT Codes

Psychiatrists can expect to see a 3.05% decrease in reimbursement this year, with the most common codes 90833 and 90837 (individual psychotherapy codes) expected to decrease by 3.24% and 3.32%, respectively.

Gastroenterology-Specific CPT Codes

Gastroenterologists can expect to see a small 1% decrease in weighted average for payments in 2023. Many of the most utilized codes will see small decreases. Code 43239 (Esophagogastroduodenoscopy Procedures), for instance, will decrease 0.28%, and code 45380 (Diagnostic and Therapeutic Colonoscopy) will decrease 0.55%. The most utilized code with the largest decrease is 43235 (EGD), which is expected to decrease 2.97%. Gastroenterology is unique in that place of service is very important, as the reimbursement for facility codes vs. non facility codes is drastically different in this specialty.

Pulmonology-Specific CPT Codes

Pulmonology is also among the few specialties that will see small increases in 2023, with the weighted average increasing 2.165%. This is driven by a 3.31% increase to code 94726 (lung volume determination) and a 2.42% increase to code 94060 (Pulmonary Diagnostic Testing and Therapies). A few less commonly used codes that will see the largest decrease are codes 94003-94004 (ventilation assist and management), which will both be dropping around 25%. These specific codes account for less than 0.5% of the total CPT volumes in the Pulmonary category, but still highly impactful for those providers that perform these specific services.

Summary

Regardless of category or specialty, providers and healthcare organizations will be well served by reviewing the CPT code changes in detail and identifying which updates will most significantly impact their business. This will help these organizations plan for CY 2023 appropriately and prepare for potential impacts on overall reimbursement expectations.

Ronnen Isakov is Managing Director Advisory Service of Medic Management Group. His background includes extensive work in areas including business advisory, valuation, network optimization, transaction support, and project management.

Anthony Morino is a Senior Consultant - Analytics with Medic Management Group. In that capacity, he supports both health system and independent practice clients in the generation of actionable data, execution of initiatives based on business analysis, compliance, and reporting.

Gino Ceriani is a Consultant – Analytics with Medic Management Group. Gino’s background includes extensive work in areas including data analytics for both large private payors as well as independent and health systems.